How to Link Your Benefits to NHS Prescription Discounts

Link your benefits to NHS prescription discounts and unlock significant savings on essential medications.

In 2025, with NHS prescription costs rising to £9.90 per item, navigating the system to reduce expenses is more critical than ever.

Whether you’re receiving Universal Credit, Pension Credit, or other qualifying benefits, connecting these to prescription exemptions can ease financial burdens.

This guide dives into practical steps, real-world examples, and insider tips to ensure you maximize your entitlements. Let’s explore how to make the NHS work for you, saving money while prioritizing health.

Prescription costs can strain budgets, especially for those on fixed incomes or with chronic conditions requiring regular medications.

The NHS offers exemptions and prepayment certificates (PPCs) to help, but the process isn’t always straightforward. Why should you spend hours deciphering eligibility when clear guidance exists?

This article breaks down the steps to link your benefits to NHS prescription discounts, offering a roadmap to savings with clarity and confidence. From eligibility checks to application tips, we’ve got you covered with up-to-date insights for 2025.

Understanding NHS Prescription Exemptions

Eligibility for free NHS prescriptions hinges on specific criteria tied to benefits. If you receive Universal Credit, Pension Credit Guarantee Credit, or Income Support, you’re automatically entitled.

The NHS Business Services Authority (NHSBSA) oversees this, ensuring those on qualifying benefits access free medications. Care leavers in north east London, aged 16-25, also qualify for free prescriptions until 2025, a unique provision.

++ What Happens During a DWP Compliance Interview?

For Universal Credit recipients, eligibility depends on income. If your take-home pay in the last assessment period was £435 or less (or £935 with child elements or limited work capability), you’re exempt.

This threshold, set by the NHSBSA, ensures low-income households benefit. Always check your award notice to confirm inclusion.

Confusion often arises with contribution-based benefits like Jobseeker’s Allowance.

These don’t automatically qualify you, but the NHS Low Income Scheme offers a fallback. This scheme assesses your income and savings, potentially granting full or partial exemptions via HC2 or HC3 certificates.

Step-by-Step Guide to Linking Benefits

Start by confirming your benefit status. Check your award notice for Universal Credit, Pension Credit, or other qualifying benefits listed on the NHSBSA website. This document is your key to proving eligibility at pharmacies.

Next, visit a pharmacy or your GP to complete the prescription form. Tick box ‘U’ for Universal Credit or ‘K’ for income-based Jobseeker’s Allowance if ‘U’ isn’t available. Always carry proof, like your award notice, to avoid delays.

If you’re ineligible for automatic exemptions, apply for the NHS Low Income Scheme. Download the HC1 form from the NHSBSA website or collect one from Jobcentres or pharmacies. Submit it with income and savings details for assessment.

Also read: Student Finance and Benefits: Can You Get Both?

For frequent prescriptions, consider a Prescription Prepayment Certificate (PPC). A 12-month PPC costs £114.50, saving money if you need over 11 items annually. Purchase online or via the NHSBSA order line at 0300 330 1341.

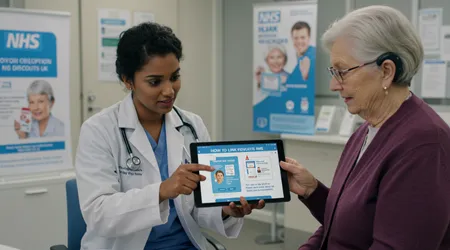

Digital tools simplify the process. The NHS App allows you to view prescriptions and generate barcodes for collection, eliminating paper forms. Download it to streamline your experience and stay updated on your entitlements.

Maximizing Savings with PPCs

A PPC is like a season ticket for prescriptions, covering all NHS prescriptions for a fixed fee. In 2025, a 3-month PPC costs £32.05, ideal for short-term needs. For hormone replacement therapy (HRT), a dedicated HRT PPC at £19.80 covers unlimited HRT items for 12 months.

Consider Sarah, a nurse on Universal Credit with asthma. She needs three inhalers monthly, costing £29.70 without a PPC. A 3-month PPC saves her £57.65 quarterly. Sarah uses the NHS App to track her prescriptions, ensuring seamless collection.

Read more: Free School Meal Expansion: What Families Should Know

Refunds are possible if you pay for prescriptions before receiving a PPC. Request an FP57 receipt from your pharmacist and apply within three months. This safety net ensures you don’t lose out during application delays.

The NHS Low Income Scheme: A Safety Net

The NHS Low Income Scheme is a lifeline for those not automatically exempt. If your savings are below £16,000 (or £23,250 in a care home), you’re eligible to apply. The scheme assesses weekly income and outgoings, offering full (HC2) or partial (HC3) help.

Take John, a retiree with modest savings and a heart condition. His application for an HC2 certificate eliminated prescription costs, saving £118.80 annually for his 12 prescriptions. John applied online, receiving approval within 18 days.

Applications require detailed financial disclosure, but the process is straightforward. Use the NHSBSA’s online portal or mail the HC1 form.

Certificates last 6 months to 5 years, depending on your circumstances, ensuring long-term relief.

Real-World Impact: Savings in Action

In 2024, the NHSBSA reported that 1.2 million people used PPCs, saving an average of £50 annually per user.

This statistic underscores the tangible benefits of linking entitlements to discounts. For chronic illness patients, savings can reach hundreds yearly.

Imagine a library card granting free books; a PPC works similarly, unlocking medications without per-item fees. For families on benefits, this can mean reallocating funds to essentials like food or utilities, enhancing quality of life.

Pharmacies across England, like Boots and Lloyds, support PPCs and exemptions. Always verify your pharmacy participates, as some regions vary. Checking locally ensures you access discounts without hiccups.

Navigating Common Pitfalls

Missteps can derail your savings. Failing to tick the correct box on prescription forms is a common error. Double-check ‘U’ or ‘K’ to avoid unexpected charges. Pharmacists can guide you if unsure.

Another pitfall is overlooking the NHS App. Many miss its barcode feature, which simplifies collection. Download it to avoid paper form hassles and track prescription statuses in real-time.

Delays in Low Income Scheme applications can cost you. Apply early, especially if your financial situation changes. Keep copies of all documents to expedite reviews or refunds.

Not all benefits qualify automatically. Contribution-based Employment and Support Allowance, for example, requires a Low Income Scheme application. Always cross-check your benefit type with NHSBSA guidelines to confirm eligibility.

Practical Examples and Tips

Consider Emma, a single mother on Pension Credit Guarantee Credit. She links her benefits to NHS prescription discounts by ticking box ‘A’ on her prescription form, securing free medications for her diabetes.

Emma’s pharmacist confirmed her eligibility using her award notice, saving her £9.90 per item.

For those with fluctuating incomes, like freelancers on Universal Credit, regular income checks are vital. Update your NHS Low Income Scheme application if your earnings drop below the threshold. This ensures continuous coverage.

Use the NHS eligibility checker on GOV.UK to confirm your status in five minutes. It’s a quick way to avoid surprises at the pharmacy counter. Bookmark the page for future reference.

Keep your award notice or exemption certificate handy when collecting prescriptions. Digital copies on the NHS App work too, offering convenience and proof in one place.

Table: NHS Prescription Cost Options (2025)

| Option | Cost | Best For | How to Apply |

|---|---|---|---|

| Single Prescription | £9.90/item | Occasional prescriptions | Pay at pharmacy |

| 3-Month PPC | £32.05 | 4+ items in 3 months | Online or 0300 330 1341 |

| 12-Month PPC | £114.50 | 12+ items in 12 months | Online or 0300 330 1341 |

| HRT PPC | £19.80 | 3+ HRT items in 12 months | Online or select pharmacies |

| NHS Low Income Scheme (HC2) | Free | Low income, savings <£16,000 | HC1 form or online |

Source: NHSBSA, 2025

Why It Matters in 2025

With inflation driving up living costs, linking your benefits to NHS prescription discounts is a smart move.

The £9.90 per-item charge adds up quickly, especially for chronic conditions. By leveraging exemptions or PPCs, you protect your finances without compromising health.

The NHS App’s digital barcode feature, introduced in 2025, revolutionizes access. It eliminates paper prescriptions for those without nominated pharmacies, making the process smoother. Why let bureaucracy stand in the way of savings?

Government initiatives, like care leaver exemptions in north east London, show a commitment to equitable healthcare. Staying informed ensures you don’t miss out on these evolving benefits.

Conclusion: Take Control of Your Savings

Linking your benefits to NHS prescription discounts empowers you to manage healthcare costs effectively.

From Universal Credit to PPCs, the NHS offers tools to ease financial strain. By following the steps outlined checking eligibility, using the NHS App, or applying for the Low Income Scheme you can save significantly.

In 2025, with prescription prices climbing, these strategies are more vital than ever. Take action today: check your benefits, explore PPCs, and use digital tools to streamline the process. Your wallet and health deserve it.

Don’t let rising costs catch you off guard. Link your benefits to NHS prescription discounts now and secure peace of mind.

Visit the NHSBSA website or download the NHS App to start saving. Why wait when relief is just a few clicks away?

Frequently Asked Questions

Who qualifies for free NHS prescriptions?

Those on Universal Credit (income ≤£435), Pension Credit Guarantee Credit, Income Support, or with valid exemption certificates qualify. Check NHSBSA for details.

How do I apply for a PPC?

Buy a PPC online at NHSBSA or call 0300 330 1341. It’s valid from purchase or a chosen date within one month.

Can I get a refund for prescriptions paid?

Yes, request an FP57 receipt from your pharmacist and claim within three months via the NHSBSA refund process.

What if my benefit isn’t listed?

Apply for the NHS Low Income Scheme if your savings are under £16,000. Submit an HC1 form for assessment.

Does the NHS App replace paper prescriptions?

For those without nominated pharmacies, the NHS App’s barcode feature eliminates paper prescriptions, simplifying collection at pharmacies.