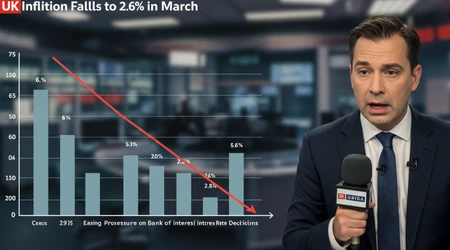

UK Inflation Falls to 2.6% in March, Easing Pressure on Bank of England’s Interest Rate Decisions

UK inflation falls to 2.6% in March, signaling a pivotal moment for the Bank of England (BoE) as it navigates interest rate decisions in 2025.

This unexpected drop, driven by lower fuel prices and softer price growth in leisure, has sparked fervent debate about whether Threadneedle Street will cut rates as early as May.

With global trade tensions and domestic cost pressures looming, the BoE faces a delicate balancing act.

This article dives into the implications of this inflation dip, exploring its drivers, the BoE’s potential moves, and what it means for UK households and businesses.

Through sharp analysis and real-world examples, we’ll unpack why this moment matters and what lies ahead.

Inflation shapes the financial landscape like a river carving a valley sometimes steady, sometimes disruptive.

When UK inflation falls to 2.6% in March, it’s not just a statistic; it’s a signal that ripples through mortgage payments, shopping baskets, and business plans.

The Office for National Statistics (ONS) reported this decline from 2.8% in February, defying City forecasts of 2.7%.

Falling petrol prices, down 1.6p per litre to 137.5p, and slower price rises for dining out were key culprits. Yet, with household bills set to climb in April, is this relief fleeting?

This piece will argue that while the drop eases pressure on the BoE, persistent wage growth and global uncertainties demand caution. Let’s explore the forces at play and their real-world impact.

The Drivers Behind the Inflation Dip

Cheaper fuel has been a linchpin in the latest inflation figures. The ONS noted a 5.3% annual drop in fuel prices, with petrol at 137.5p per litre.

This decline reflects global oil price softening, partly due to US tariff policies dampening demand.

For a delivery driver like Sarah in Manchester, this means lower costs, freeing up cash for other expenses. However, clothing prices rose 1.1%, offsetting some gains. Why does this matter?

It shows inflation’s uneven impact relief in one area, pressure in another.

Beyond fuel, leisure costs grew more slowly. Dining out and entertainment price hikes eased, reflecting cautious consumer spending amid economic uncertainty.

This aligns with a weakening labour market, as ONS data shows employment fell in March. For small businesses like cafés, slower price growth signals weaker demand.

Could this be a precursor to deeper economic slowdown? The interplay of these factors underscores the BoE’s challenge in reading the economy’s pulse.

++ Best Banks in the UK for Savings Accounts in 2025

Another factor is global trade dynamics. US President Donald Trump’s tariffs have lowered oil prices, indirectly aiding UK inflation’s decline.

Yet, these same tariffs threaten supply chain disruptions, which could reverse gains. For instance, a UK manufacturer importing components may face higher costs if tariffs escalate.

This global-local nexus complicates the BoE’s forecasting, as external shocks could derail domestic stability.

Bank of England’s Interest Rate Dilemma

With UK inflation falls to 2.6% in March, markets see an 86% chance of a May rate cut, potentially lowering the base rate from 4.5% to 4.25%.

The BoE has already cut rates three times since August 2024, from a 16-year high of 5.25%. This latest data strengthens the case for further easing, as inflation nears the BoE’s 2% target.

But is the bank ready to act?

Core inflation, excluding volatile items like energy, fell to 3.4% from 3.5%, per ONS. This suggests underlying price pressures are easing, giving the BoE room to maneuver.

Also read: UK Salary Guide: How Much Do Different Jobs Pay?

For a homeowner like James in Leeds, a rate cut could lower mortgage payments, offering breathing space.

Yet, the BoE remains cautious, wary of wage growth at 6%, which fuels spending and could reignite inflation.

Global uncertainties, particularly Trump’s tariff plans, add complexity.

Ruth Gregory of Capital Economics argues tariffs could depress global growth, tilting risks toward lower inflation and faster rate cuts.

However, if businesses pass on higher import costs, inflation could spike. The BoE must weigh these risks, balancing growth against price stability in a turbulent world.

The labour market’s softening adds another layer. With firms cutting job adverts, as ONS reports, demand may weaken, supporting rate cuts.

But persistent wage growth could keep services inflation sticky, as seen at 4.7%. For the BoE, it’s like walking a tightrope cut too soon, and inflation flares; wait too long, and growth stalls.

Read more: How to Build a Good Credit Score in the UK

What This Means for Households and Businesses

For households, UK inflation falls to 2.6% in March brings cautious optimism. Lower fuel and leisure costs ease budgets, but April’s council tax and utility bill hikes loom.

The ONS predicts inflation could hit 3% next month due to these pressures. For a family like the Thompsons in Bristol, this means tighter budgeting despite recent relief.

Mortgage holders stand to gain if rates fall. A quarter-point cut could save £50 monthly on a £200,000 mortgage, per industry estimates.

Yet, savers may see lower returns, as banks adjust rates downward. Rachel Reeves, UK Chancellor, called the inflation drop “encouraging,” but warned of challenges ahead. Households must brace for a bumpy ride.

Businesses face a mixed outlook. Lower inflation reduces input costs, but tariff-related uncertainties threaten supply chains.

A London retailer importing goods may face higher prices if trade wars intensify. Meanwhile, weaker demand, as seen in falling job adverts, pressures revenue. Businesses need clarity from the BoE to plan investments.

The hospitality sector, hit by slower leisure price growth, feels the pinch. A pub owner in Birmingham reported fewer customers, reflecting cautious spending.

If the BoE cuts rates, cheaper borrowing could spur investment, but persistent wage pressures may force price hikes. Businesses are caught in a wait-and-see game.

The Global Context and Tariff Risks

The global stage is a critical backdrop. UK inflation falls to 2.6% in March, partly due to lower oil prices tied to Trump’s tariffs.

These policies depress global demand, keeping energy costs down. However, they risk disrupting UK imports, potentially raising prices for goods like electronics. How will the BoE navigate this?

The US Federal Reserve’s cautious rate cuts, with rates at 4.25%-4.5%, reflect similar concerns. Reuters reported US consumer prices fell in March, but tariffs could reverse this.

For the UK, a stronger pound, up 0.2% to $1.326, helps curb import costs. Yet, prolonged trade tensions could weaken sterling, stoking inflation.

Eurozone inflation at 2.2% and Germany’s at 2.3% suggest a regional trend of easing prices, per Euronews. The European Central Bank may cut rates in April, influencing BoE thinking.

If global central banks ease in tandem, the BoE may follow suit to avoid currency imbalances. Global coordination is key.

Trade wars could also depress UK exports. A Yorkshire manufacturer selling to the US faces higher costs if retaliatory tariffs emerge.

This could dampen growth, pushing the BoE toward deeper rate cuts. The interplay of global and domestic factors makes 2025 a high-stakes year.

The Road Ahead: Opportunities and Risks

Looking forward, UK inflation falls to 2.6% in March sets the stage for cautious optimism. The BoE’s May meeting is pivotal, with markets betting on a rate cut.

Luke Bartholomew of Aberdeen calls it “increasingly nailed on,” but warns of inflation spikes from energy bills. What’s the best path forward?

A gradual rate-cutting cycle could support growth without overheating. The ONS reports GDP grew 0.5% in February, a positive sign.

For small businesses, cheaper loans could fund expansion, like a café upgrading equipment. Yet, the BoE must monitor wage-driven inflation to avoid missteps.

Households should seize opportunities, like locking in fixed-rate mortgages before potential volatility. Savers might explore high-yield accounts to offset lower rates.

The BoE’s data-driven approach, as outlined on its website, ensures flexibility. But with tariffs looming, adaptability is crucial.

The risk of an inflation rebound remains. April’s bill hikes and potential trade disruptions could push inflation above 3%, per ONS forecasts.

The BoE may pause cuts if services inflation persists. For policymakers, it’s a chess game each move must anticipate the opponent’s response.

Data Snapshot: Inflation and Rates

| Metric | February 2025 | March 2025 |

|---|---|---|

| CPI Inflation | 2.8% | 2.6% |

| Core Inflation | 3.5% | 3.4% |

| Petrol Price (per litre) | 139.1p | 137.5p |

| Base Rate | 4.5% | 4.5% |

Engaging the Future: What’s at Stake?

Think of the UK economy as a ship navigating stormy seas. UK inflation falls to 2.6% in March offers a moment of calm, but dark clouds tariffs, wage pressures loom.

The BoE’s next moves will determine whether we sail smoothly or hit rough waters.

A 2024 Capital Economics study estimated that a 10% global tariff hike could cut UK GDP by 0.5%.

This statistic underscores the stakes.

For individuals, the impact is tangible. Take Emma, a nurse in Cardiff, whose budget stretches further with lower fuel costs but tightens with rising bills.

Or consider a tech startup in Cambridge, weighing expansion amid tariff risks. These stories ground the numbers, showing why policy matters.

The BoE’s challenge is to foster stability without stifling growth.

UK inflation falls to 2.6% in March gives it breathing room, but caution is warranted. Will policymakers seize this chance to support households and businesses, or will global shocks force a rethink?

The answer will shape 2025.

In closing, UK inflation falls to 2.6% in March is a milestone, not a destination. It signals progress but warns of challenges.

Households should plan for volatility, businesses must stay agile, and the BoE must tread carefully. By balancing data with foresight, the UK can navigate this economic crossroads.

Stay informed, stay prepared because the next wave is coming.

Frequently Asked Questions

1. Why did UK inflation fall to 2.6% in March?

Lower fuel prices, down 5.3% annually, and slower leisure cost increases drove the decline, per ONS data, despite rising clothing prices.

2. Will the Bank of England cut interest rates in May?

Markets see an 86% chance of a cut to 4.25%, but persistent wage growth and tariff risks may prompt caution.

3. How does this affect my mortgage?

A rate cut could save £50 monthly on a £200,000 mortgage, but savers may see lower returns on deposits.

4. What risks could push inflation up again?

April’s council tax and utility bill hikes, plus potential tariff-driven import cost increases, could lift inflation above 3%, per ONS.

5. How do global tariffs impact UK inflation?

Trump’s tariffs lower oil prices, aiding inflation’s fall, but supply chain disruptions could raise goods prices, complicating BoE decisions.