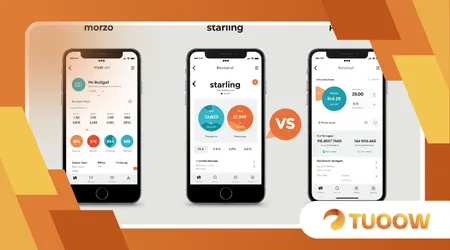

Are Neobanks Offering Better Value? Comparing Monzo, Starling & Revolut

In 2025, neobanks like Monzo, Starling, and Revolut are reshaping how UK consumers bank, challenging traditional institutions with sleek, tech-driven solutions.

These digital-first platforms promise lower fees, intuitive apps, and innovative features tailored to modern financial needs. But do they truly deliver better value than high-street banks?

This question drives a deeper look into their offerings, from budgeting tools to international spending perks.

By comparing Monzo, Starling, and Revolut, we’ll uncover what sets neobanks apart and whether they’re the smarter choice for your finances.

With consumer trust in traditional banks waning evidenced by a 31% surge in Monzo’s customer base to 9.7 million in 2024 this analysis is timely.

Let’s dive into how these neobanks stack up in delivering value today.

The rise of neobanks reflects a broader shift toward digital convenience, fueled by frustration with legacy banking’s bureaucracy.

Monzo, Starling, and Revolut, all UK-based, have capitalized on this discontent, offering mobile-first experiences that prioritize user control.

But value isn’t just about flashy apps it’s about fees, features, and reliability. This piece will dissect their strengths and weaknesses, using real-world examples to illustrate their impact.

Are neobanks the future of finance, or are they overhyped? We’ll explore their financial performance, customer experience, and unique tools to answer this.

The Financial Edge: Fees and Costs

Monzo’s fee structure appeals to budget-conscious users with its free basic account. Overseas spending incurs no fees, using Mastercard’s exchange rate. However, cash withdrawals in the EEA are limited for non-primary accounts.

Starling simplifies things with one fee-free account, no paid tiers. Overseas withdrawals and card payments are free, ideal for frequent travelers seeking cost savings.

Revolut’s free account offers fee-free spending abroad, but its premium plans unlock perks like higher withdrawal limits. Its 2024 pretax profit of £1.1 billion signals financial strength.

++New FCA Consumer Duty: What It Means for Your Banking Services

Cash deposits highlight differences: Monzo charges £1 per deposit beyond £1,000 every six months, while Starling’s £5,000 annual limit is more generous.

Value here hinges on usage. Frequent travelers might prefer Starling’s no-fee model, while Revolut’s premium tiers suit those wanting extras like insurance.

Features That Define User Experience

Monzo’s app shines with budgeting tools like “Round-Up,” saving spare change from purchases. Users can track shared expenses and automate bill payments.

Starling focuses on simplicity, offering spending categorization and real-time notifications. Its app earns high Trustpilot scores, with 79% of users giving five stars.

Revolut stands out with multi-currency accounts, letting users hold and exchange up to 30 currencies. This is a game-changer for global travelers or freelancers.

Also read: How UK Finfluencers Are Shaping Personal Investing: Pitfalls & Protection

Monzo’s Pots feature allows users to earmark funds for specific goals, like saving for a holiday, enhancing financial discipline with visual clarity.

Starling’s biometric logins and card-locking options add security, appealing to users prioritizing safety in a digital-first banking world.

Business Banking: Supporting Entrepreneurs

Starling’s business accounts are fee-free, with tools for invoicing and expense tracking, making it a favorite for freelancers and small businesses.

Monzo’s business accounts support payment links and QR codes, streamlining transactions for small firms. Its 450,000 business customers reflect strong adoption.

Revolut’s business accounts cater to global enterprises, offering multi-currency payments and integrations with accounting software, ideal for cross-border operations.

For example, a freelance designer using Starling can track project expenses effortlessly, while Revolut’s currency tools suit an e-commerce seller trading internationally.

Read more: How to Open a Bank Account in the UK: Full Guid

Monzo’s cashback feature rewards business users, adding value for startups managing tight budgets, unlike traditional banks’ often rigid offerings.

Growth and Stability: Can They Last?

Revolut’s 52.5 million customers and 72% revenue growth in 2024 showcase its dominance, outpacing even HSBC in user numbers.

Monzo’s 88% deposit growth to £11.2 billion in 2024 signals trust, with a £6 billion IPO looming, hinting at strong market confidence.

Starling, with £223 million profit in 2024, lags behind, hit by a £29 million regulatory fine, raising questions about operational stability.

Imagine neobanks as agile startups racing against lumbering banking giants Revolut’s speed is unmatched, but Starling’s stumbles show risks in rapid scaling.

Monzo’s focus on customer retention, with 33% of users making it their primary bank, suggests a stable base for long-term growth.

Innovation and Future Potential

Revolut’s exploration of a stablecoin in 2025 highlights its push into crypto, appealing to tech-savvy users eyeing decentralized finance.

Monzo’s mortgage integration lets users track home loans in-app, a nod to neobanks tackling big-ticket financial products traditionally dominated by legacy banks.

Starling’s SaaS platform aims to export its tech to other banks, a bold move to diversify revenue beyond consumer banking.

For instance, a young professional using Monzo’s mortgage tracker gains clarity on equity, while Revolut’s crypto tools attract speculative investors.

Neobanks must innovate to stay ahead Revolut’s global expansion contrasts with Starling’s US ambitions, which hinge on regulatory navigation.

Comparing the Big Three: A Snapshot

| Feature | Monzo | Starling | Revolut |

|---|---|---|---|

| Free Account | Yes | Yes | Yes |

| Overseas Spending Fees | None (Mastercard rate) | None (Mastercard rate) | None (limits on free plan) |

| Cash Deposit Limit | £1,000/6 months (£1 per deposit) | £5,000/year (0.7% over limit) | Varies by plan |

| Business Accounts | Yes (payment links, QR codes) | Yes (invoicing, expense tracking) | Yes (multi-currency, integrations) |

| Unique Feature | Round-Up savings | Spending categorization | Multi-currency accounts |

This table highlights how neobanks cater to different needs Monzo’s savings tools, Starling’s simplicity, and Revolut’s global focus.

Are Neobanks Truly Better Value?

Why settle for clunky banking when neobanks offer tailored solutions? Monzo’s budgeting tools empower users like Sarah, a teacher saving for a car.

Revolut’s multi-currency accounts suit Tom, a freelancer paid in euros. Starling’s fee-free model fits frequent travelers like Emma. Yet, Starling’s recent fine raises red flags about reliability.

Revolut’s £1.1 billion profit suggests stability, but premium plans may deter cost-conscious users. Monzo’s 9.7 million customers reflect trust, yet its cash deposit fees sting.

Value depends on prioritiestravel, business, or savings. Neobanks excel in flexibility but lack the branch network some still crave. Their digital-first approach, with 68% positive sentiment on X, outshines traditional banks.

Ultimately, neobanks redefine value through innovation, but their edge isn’t universal. Compare their offerings against your needs to decide if they’re truly better.

The future of banking is digital Monzo, Starling, and Revolut are leading, but choose wisely based on your financial goals.

Frequently Asked Questions

1. Are neobanks safe for my money?

Yes, Monzo and Starling are FCA-authorised, offering FSCS protection up to £85,000. Revolut’s UK banking licence is in mobilisation, so check its status.

2. Which neobank is best for international travel?

Revolut’s multi-currency accounts and Starling’s fee-free overseas spending are top choices. Monzo suits EEA travel but has withdrawal limits.

3. Can neobanks replace traditional banks?

For digital-savvy users, yes, due to lower fees and better apps. However, those needing branches or complex loans may still prefer traditional banks.

4. Do neobanks offer loans or mortgages?

Monzo offers personal loans and mortgage tracking. Starling provides overdrafts. Revolut is exploring mortgages but focuses on multi-currency tools.

5. How do neobanks make money?

They earn through interchange fees, premium subscriptions, and business accounts. Revolut’s £3.1 billion revenue in 2024 shows their profitability.